Trade The Pool Review for 2024

Some of the links on this page may link to our affiliates. Learn more about our affiliate policies.

Last Updated: January 5, 2023

Author: OPT Research Team

Trade The Pool Stock Trader Funding

Cost:

$240-$1180

Current Big Discount:

We are working on getting one for you

Instruments:

Stocks

Trading Period:

30 Days

Free Trial:

14-days

Payout Type:

Depending on the account:

- 50/50 (Super)

- 55/45 (Extra)

- 65/35 (Ultimate)

Highlights:

1 step evaluation, unlimited trading power, can trade almost any stock and ETF in the U.S. markets, no data fees, no platform fees, no PDT rule

Who is Trade The Pool?

Trade The Pool is a brand created by Five Percent Online Ltd. This company also operates The5ers.com, which is an online prop site that has a high reputation and is well-respected. The 5%ers was established in 2016, so it has been around for quite some time and is time-tested.

The years of experience in the funding-traders industry have shaped how Trade The Pool operates. Their team includes active traders who have first-hand knowledge. They have lived through every aspect of trading, which motivated them to create the most rewarding trading environment (according to the Trade The Pool website).

Trade The Pool is driven by innovation and leadership, which showcases how they created this stock-funded trader program. Being founded by Gil Ben Hur, who is also the founder of the 5ers, definitely helped the prop firm to steer clear of making rookie mistakes.

THE FUNDING MODEL - OVERVIEW

Trade the Pool operates a single-phase challenge model. To get funded, you only need to pass 1 step evaluation. This program offers unlimited purchasing power since you are trading in 1 pool. The only parameter of concern regarding risk management is the maximum daily loss.

The standard Profit Target is set to be 6 times larger than your daily loss limit. Similar to the profit target calculation, the maximum drawdown is 3 times the daily loss limit. Minimum amount of trades that each trader must reach is 50. This gives the Trade The Pool funded stock trader program enough moves made by the trader to really assess the skills and risk management capabilities.

| Account | Super Buying Power | Extra Buying Power | Ultimate Buying Power |

|---|---|---|---|

| Daily Loss | $700 | $1300 | $2000 |

| Profit Target | $4200 (6xDL) | $7800 (6xDL) | $12000 (6xDL) |

| Max DD | $2100 (3xDL) | $3900 (3xDL) | $6000 (3xDL) |

| Payout Title | 50/50 | 55/45 | 65/35 |

| Minimum Trades | 50 | 50 | 50 |

| Pump | 5% | 8% | 15% |

| Trading Period | 30 days | 30 days | 30 days |

| Price | $240 | $415 | $1180 |

The three different types of accounts that are available for you to choose from are the following:

- Super Buying Power Account - Price: $240

- Extra Buying Power Account - Price: $415

- Ultimate Buying Power Account - Price: $1180

The main differences between the three are the Daily Loss, which then is directly related to the Profit Target and Maximum Drawdown. Another thing to keep in mind is that the more expensive the account you choose the higher payout amount you will be rewarded.

Differently from futures funded trader programs and forex funded trader programs, Trade The Pool does not have a limit on the buying power. This is the reason why you do not see account sizes listed in dollar amounts.

Trade The Pool - Pump and Dump Explained

What is a Pump?

Contrary to what it might sound like, the Pump is something that Trade The Pool awards you with after 5 consecutive winning days. The prop firm enables you to take on more risk than initially allowed with the program of your choosing. Since traders are only limited by the daily loss, Trade The Pool will increase it by the percentage stated in the account breakdown above:

- Super Buying Power: 5% Pump

- Extra Buying Power: 8% Pump

- Ultimate Buying Power: 15% Pump

Example:

- Daily loss = $700

- On the first day, you made $300 profit

- Second-day profit was $400

- Third-day $500

- Fourth-day at $400

- Fifth-day $500

- In total = $2100 (3 times the initial daily loss)

- Your daily loss increases automatically by one step to $735

What is a Dump?

As you have probably guessed it, a dump is the opposite of the pump. A dump can only occur if you have already gotten the Pump before, and it can only take your daily loss limit back to the initial starting point. A dump occurs when your account has had 5 consecutive losing trading days as well as at least 2 times the initial daily loss limit.

Let's go through a quick example:

- Daily loss = $700

- After 5 consecutive winning days you got the Pump of 5%

- Right afterwards your first day was a loss of $200

- Next day was a loss of $300

- Third day was a loss of $400

- Fourth day you had a loss of $200

- Fifth day was a loss of $300

- In total, you had a loss of $1400 which is 2 times the initial daily loss limit

- You get hit with a dump and the pump is gone. Your daily loss limit is now back to $700 again.

Trade The Pool Rules

Trade The Pool prop firm is quite different from other pop trading companies that we have reviewed before. It is not surprising that the rules for their programs are different as well. To save you some time, we have reviewed the website and all the fine print, and we will provide you with the details below.

Profit Target to Complete Evaluation Stage

To get funded, you need to pass 1 step evaluation and must have made at least 50 trades within 30 days. The main thing that you should keep in mind is your daily loss limit, because this number is what determines your profit target (6 times your daily loss) as well as the max drawdown (3 times your daily loss).

Example: if you have signed up for the Super Buying Power account, your daily loss is set to be $700. This means that for you to reach the profit target, you will have to make 6 times the profit of your daily loss. $700 x 6 = $4200. Meanwhile, your maximum drawdown is 3 times the daily loss. $700 x 3 = $2100.

Minimum 50 Trades Requirement and Trading days

All evaluation accounts must have completed at least 50 trades and must have traded for a minimum of 30 days. This is a way for Trade The Pool prop firm to mitigate the risks and protect themselves passing traders that hit a lucky trade and waited out the period of time needed.

Daily Loss Relationship to Drawdown

The program you choose will determine the daily loss allowance. It can be as low as $700, $1300, or $2000. Maximum drawdown is just three times that amount: $2100, $3900, and $6000. This can be adjusted depending on the performance, as mentioned above via Pumps.

When is it possible to trade?

Trades can only be made while the US stock exchange is open. So, for example, you can trade at 9.30 ET but must finish by 15.55 ET (5 min before closing).

Max Exposure per Trade

The max exposure per trade is 30% of the daily loss. To quickly figure out what is the maximum amount of money that you are allowed to trade with a single click, just take 30% of the daily loss limit that you received with your account. For instance, if your daily loss is $700, your maximum exposure per trade is $700 x 0.3 = $210.

Max Exposure in Floating

Exposure is the number of shares multiplied by the stock's price

- Super Buying Power: Max Exposure in Floating = $80,000

- Extra Buying Power: Max Exposure in Floating = $160,000

- Ultimate Buying Power: Max Exposure in Floating = $260,000

Holding trades

All trades with this prop firm must be closed by the current day's close at 15.55 ET. This only applies to day traders.

Trading Instruments

Trades can be made on almost all stocks and ETFs in the US. There are more than 12,000 instruments.

Trade The Pool Program Features

Trade The Pool is not focused on the rules alone. While the company needs to balance their risks and ensure that only qualified traders get through their evaluation, they do offer quite a few cool options to help traders. Let's go over a few that stood out.

Start Over Button

You can reset your daily losses for the trading day by using the start button. You will be charged a small, but pretty important fee for trading. The start over button will be located in the upper right corner of your dashboard. Here is the breakdown of the current "Reset Button" pricing on their site:

- For the Super BP, the reset fee will be $50

- Your reset fee for Extra BP will be $100

- The Ultimate BP reset costs $250

Redemption fee

Day traders who think they can pass the evaluation in one month are eligible for a redemption fee. You can pay the redemption fee if you fail to succeed in the first four weeks and then continue where you are at the beginning. You can save all your progress and start over.

The redemption fee is the exact same as the sign-up fee.

14-Day Free Trial

Yes, Trade The Pool offers a 14-day free trial to new traders.

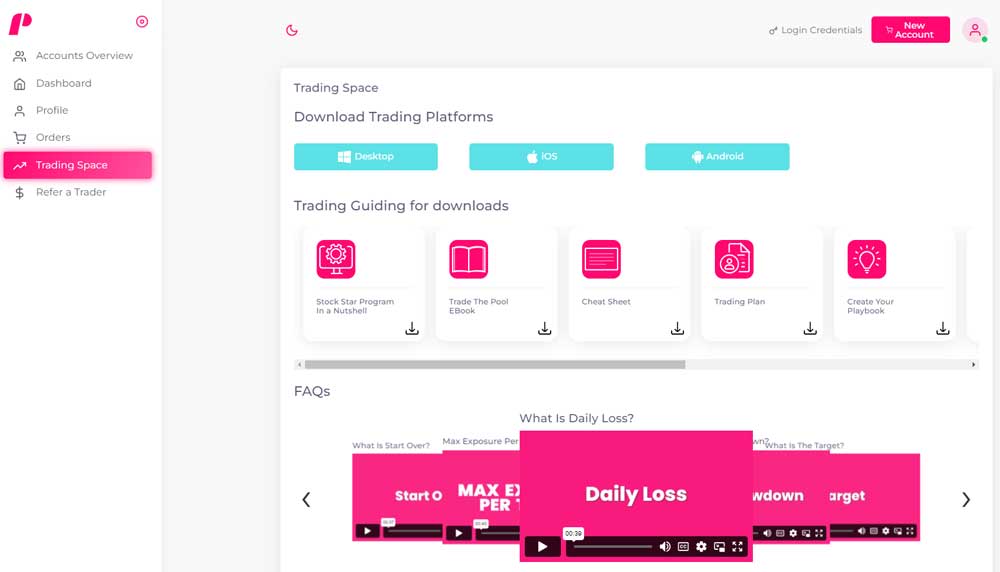

Trade The Pool Trading Space

It is pretty cool what Trade The Pool trader funding program has done with the dashboard that they provide. The section that we liked the most is called the Trading Space (screenshot attached above). In this section you can find the following:

- Links to Download Trading Platforms (Desktop, iOS, Android)

- Trading Guiding for downloads

- FAQs in video format

- Stock Terminology in video format

Trade The Pool Review Conclusion

The Trade The Pool prop firm has a lot of backup from the industry experience as well as reputation of its founders. This is typical of the 5 %ers, who love pushing the envelope and offering traders exciting new experiences. On the surface, this is a great opportunity for those more experienced trading with stocks as opposed to forex/commodities/indexes, which are the normal instruments most prop firms are limited to.

Although the unlimited buying power concept is intriguing, it can also limit loss and trick less experienced traders into overleveraging. It opens up opportunities and offers great earnings for the more experienced trader. We would love to see more information on the website.

We are happy to recommend this prop company due to their good reputation. However, we advise caution because of the lack of information on their site as well as the limited amount of programs that fund stock traders to compare them to.

Risk Disclosure: This content is provided for informational purposes only. We strive to make the content accurate and current by updating it often. Sometimes, the actual data may differ from what is stated on our website. onlineproptrading.com operates independently. Although we are an independent platform, advertisements and sponsored products may compensate us. We also receive compensation for clicking on links on our website. Authors and contributors are not certified or registered financial advisors. Before making any financial decisions, you should consult a financial professional.

OPT Research Team

Author

OnlinePropTrading.com Research Team consists of a number of financial market and product specialists. Articles published by OPT Research Team generally have been written by active day traders, data analysts or financial market researchers. We aim to provide general education to our readers with no outside bias. We strongly believe that this differentiates us from our competitors.

Looking to get funding for your trades?

Stay Up To Date With The Best Funding Programs

Contact Us

We will get back to you as soon as possible.

Please try again later.

All Rights Reserved | Online Prop Trading

Disclaimer: This content is provided for informational purposes only. We strive to make the content accurate and current by updating it often. Sometimes, the actual data may differ from what is stated on our website. onlineproptrading.com operates independently. Although we are an independent platform, advertisements and sponsored products may compensate us. We also receive compensation for clicking on links on our website. Authors and contributors are not certified or registered financial advisors. Before making any financial decisions, you should consult a financial professional.